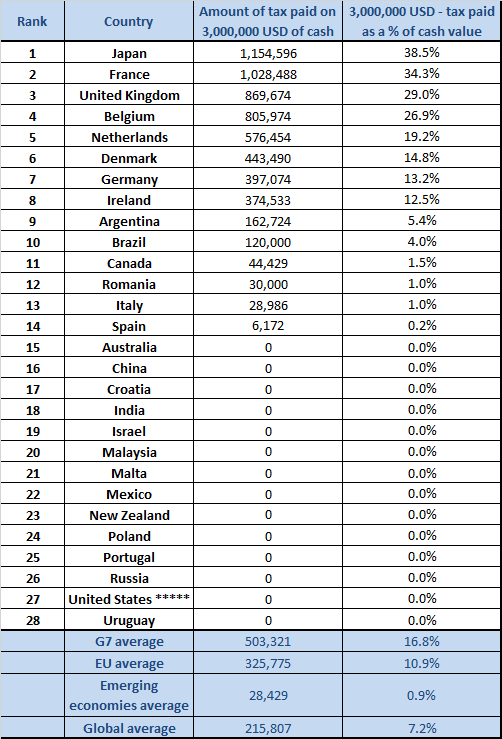

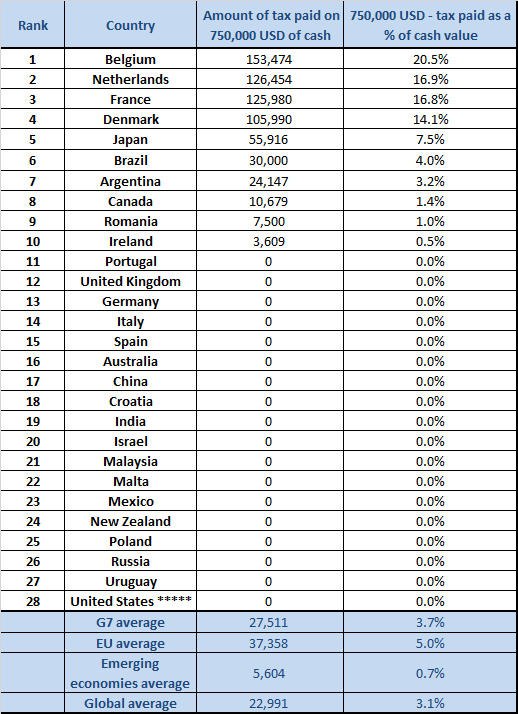

Inheritance Tax rates in G7 and EU countries ten times higher than emerging economies - UHY InternationalUHY International

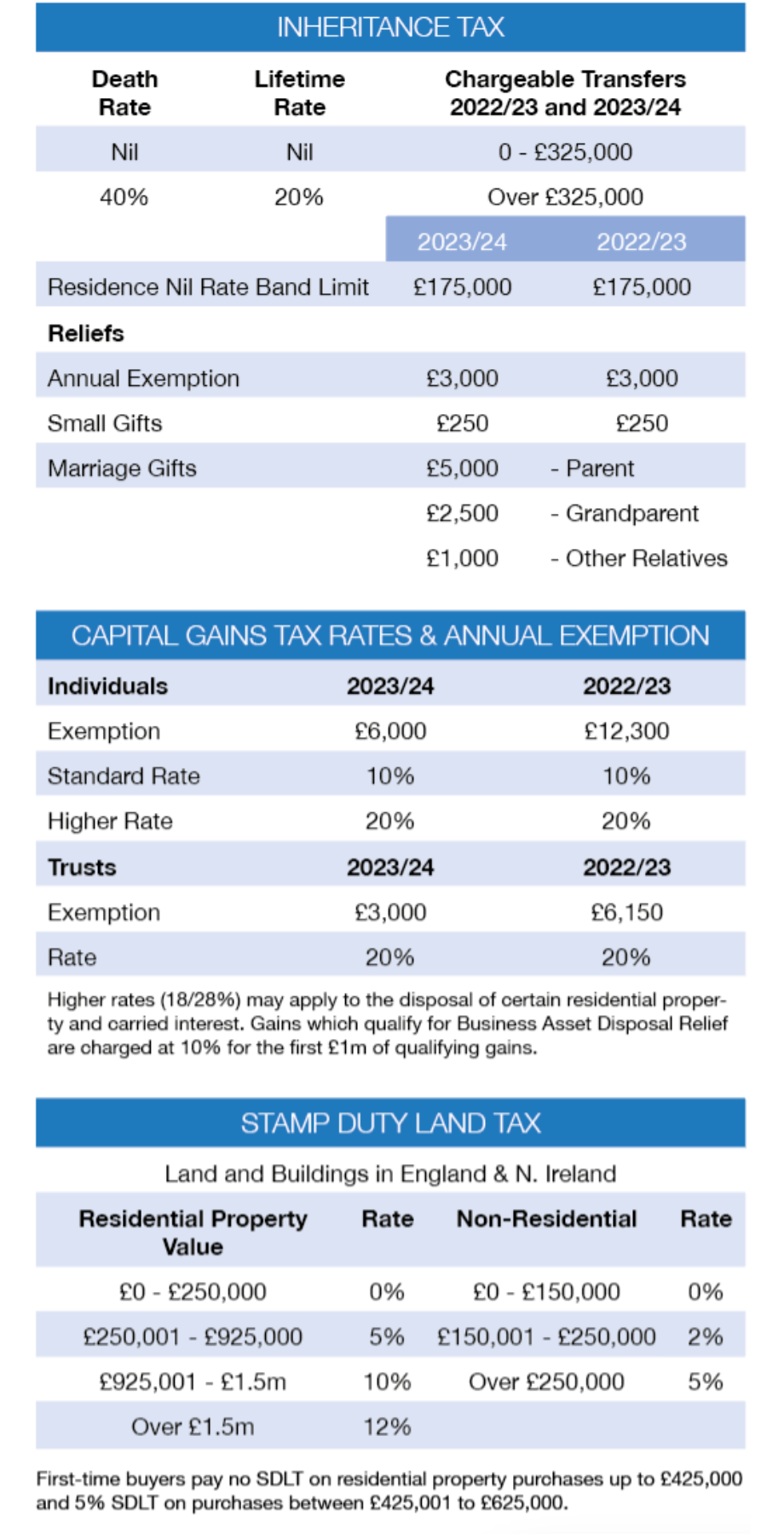

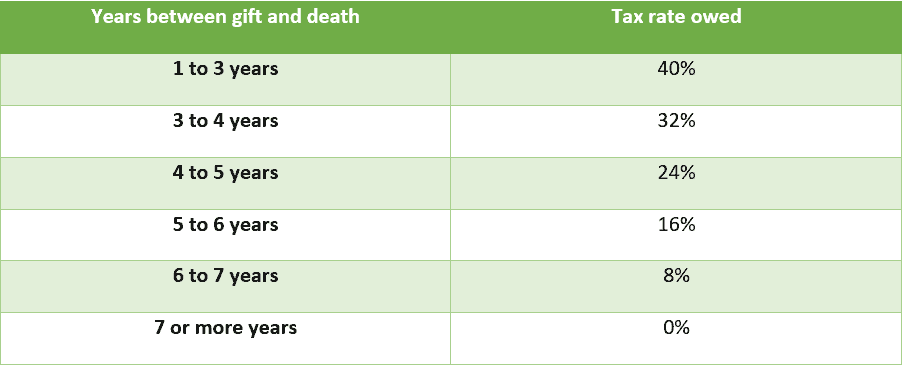

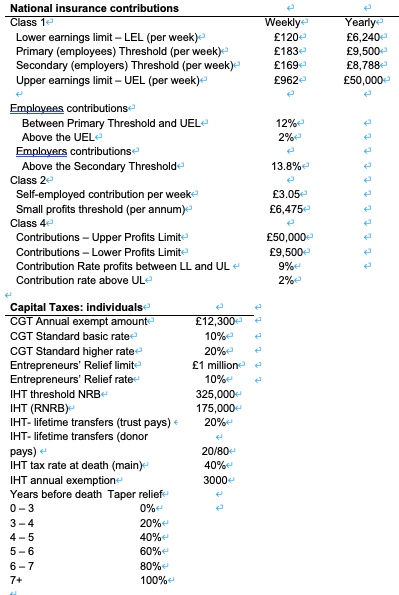

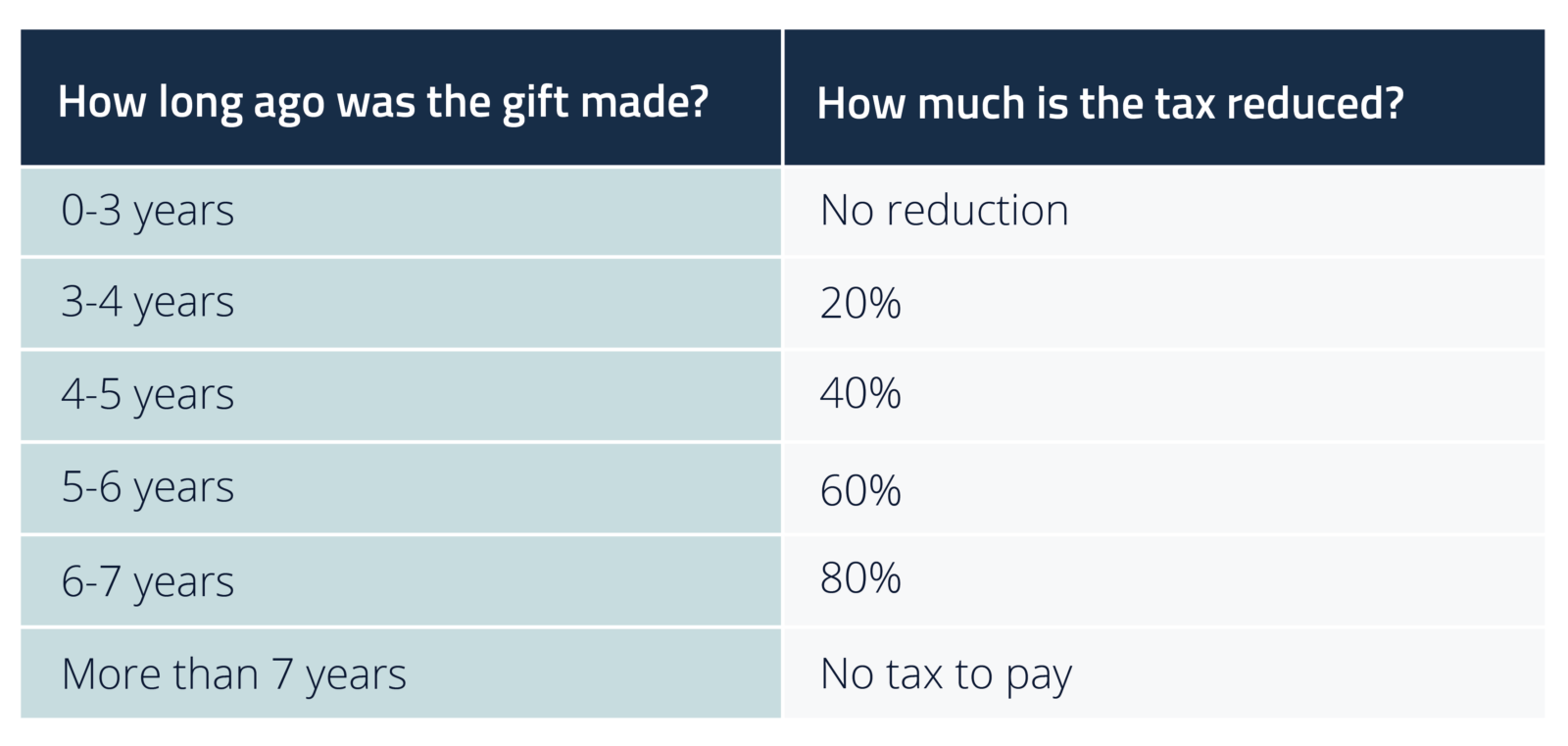

NRB Tables - Nil rate band summary for IHT - Inheritance Tax nil rate bands, limits and rates IHT400 - Studocu

UHY International: Inheritance Tax rates in G7 and EU countries ten times higher than emerging economies - UHY Victor

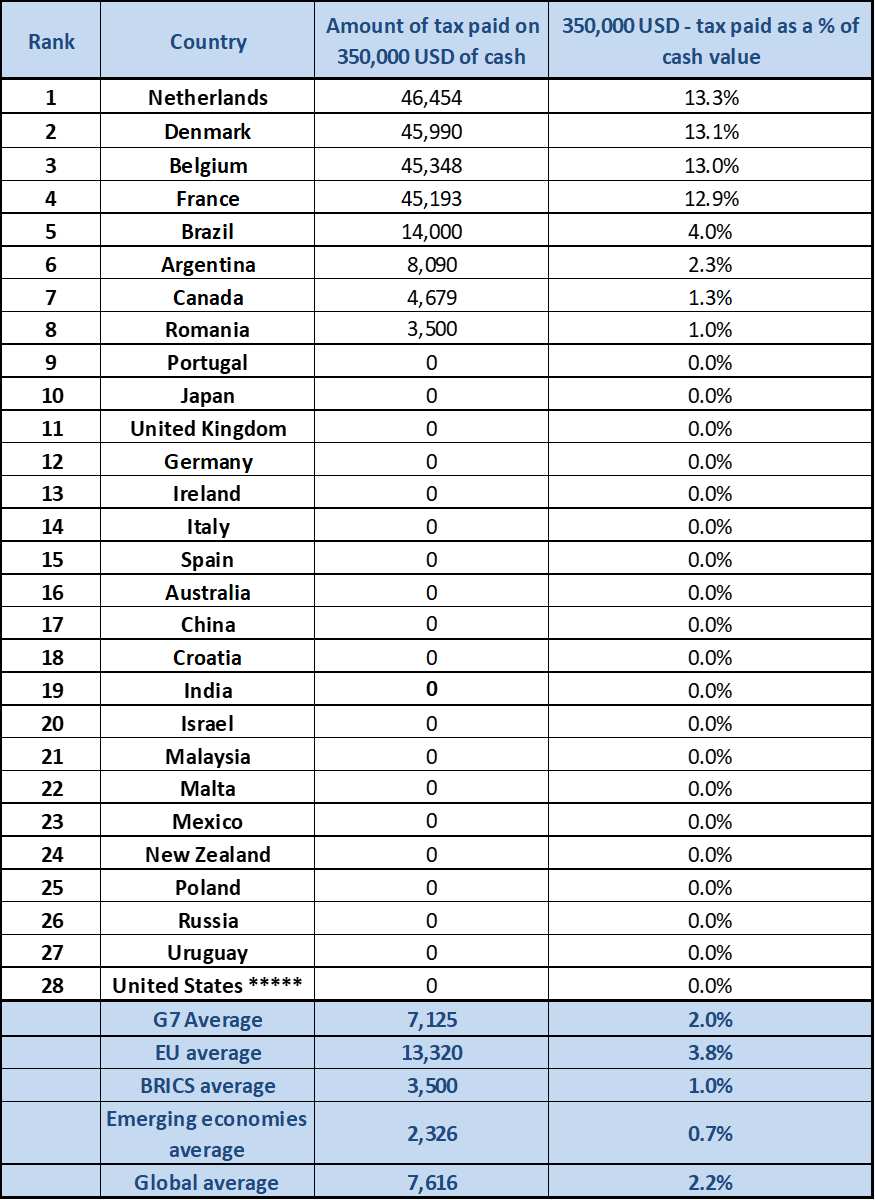

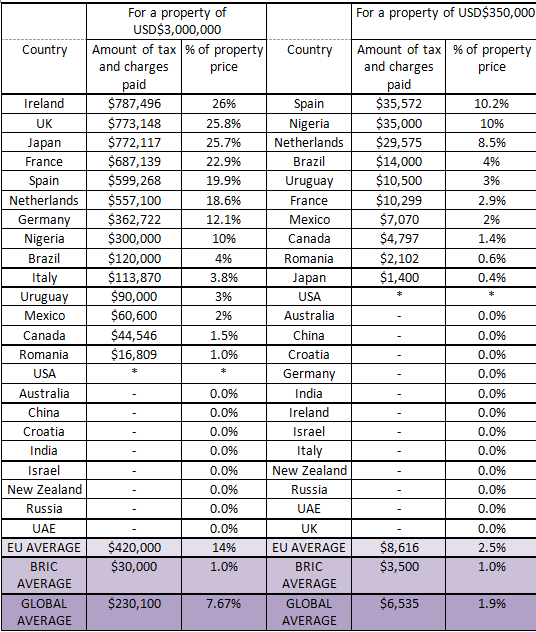

UK and Ireland impose highest taxes on inheritance of all major economies - UHY InternationalUHY International

Kaplan-Meier survival curves, risk tables, and survival analysis for... | Download Scientific Diagram