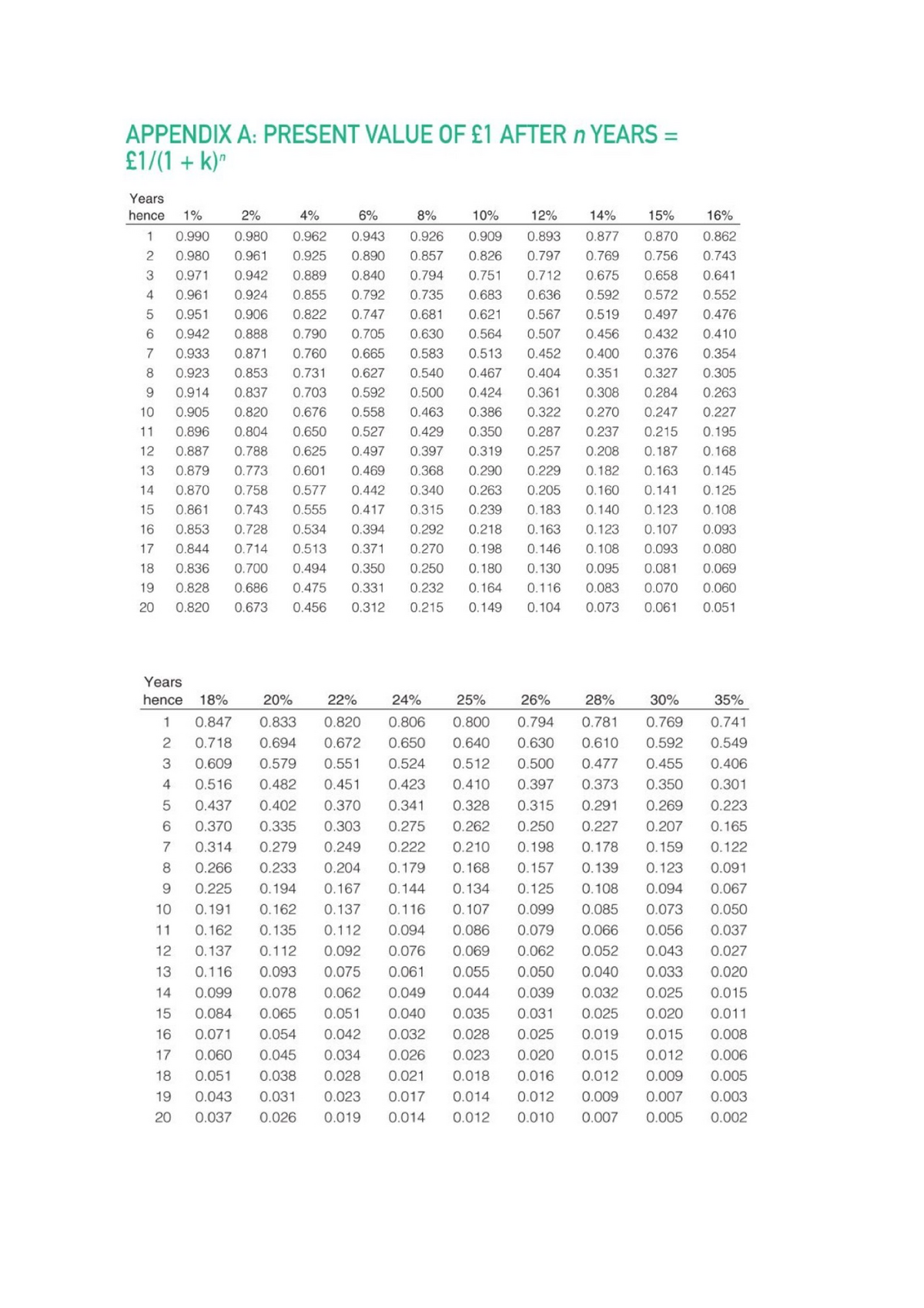

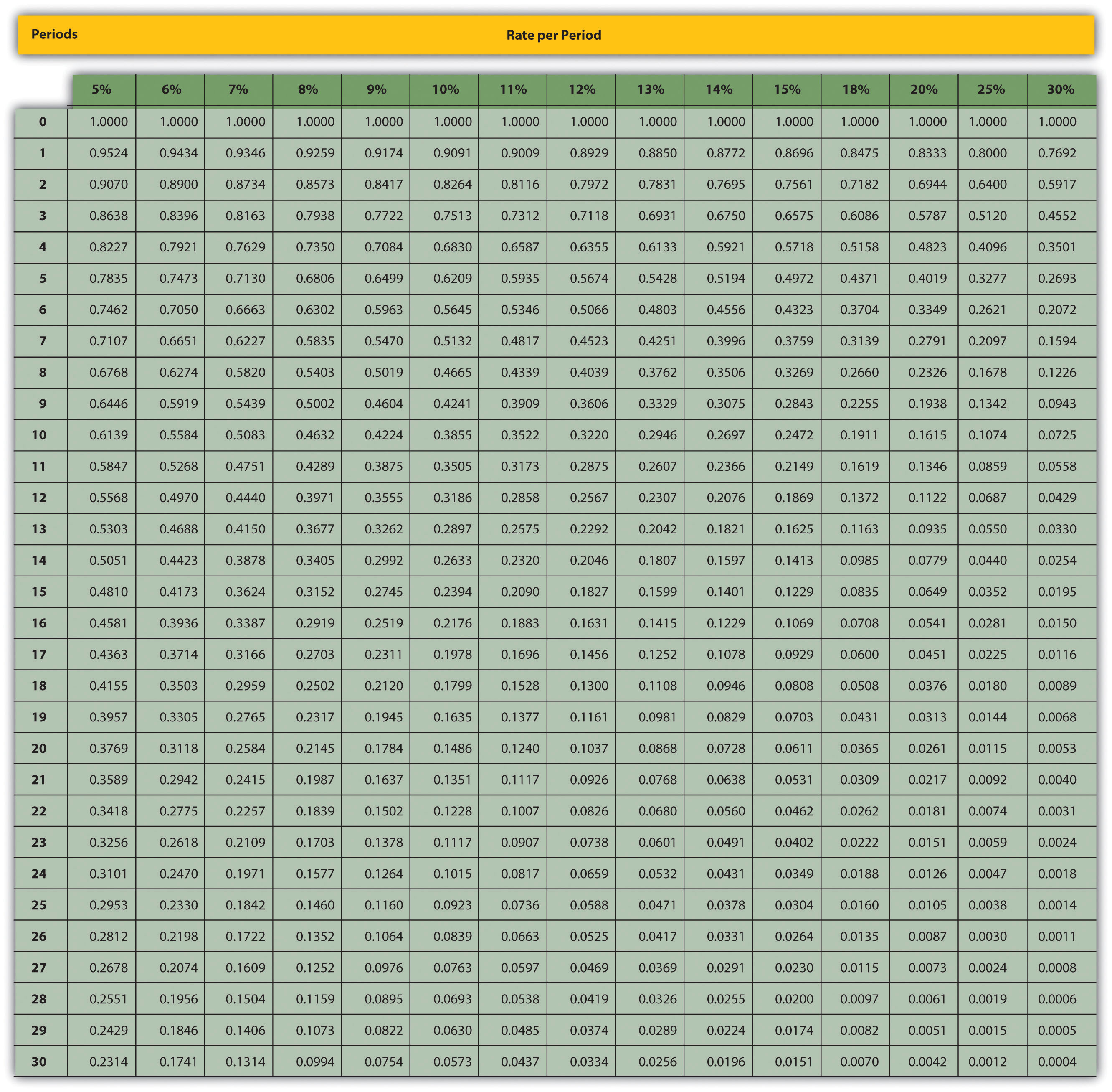

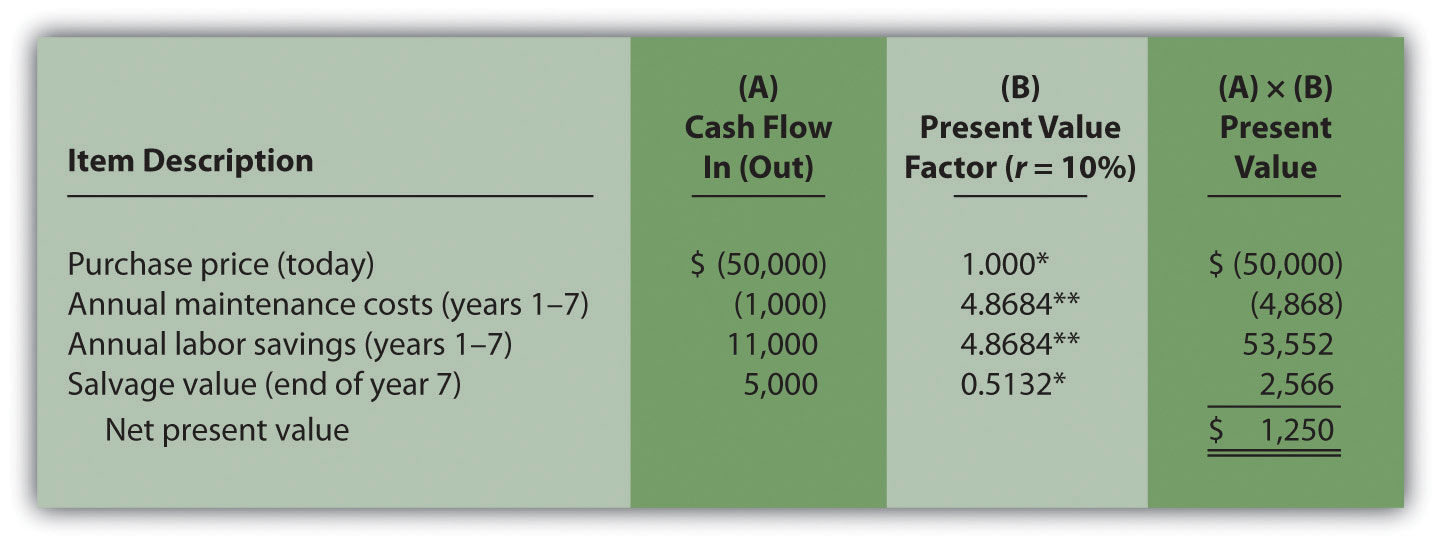

Net Present Value Covering Formulae And Table Period And Revenue | PowerPoint Slide Images | PPT Design Templates | Presentation Visual Aids

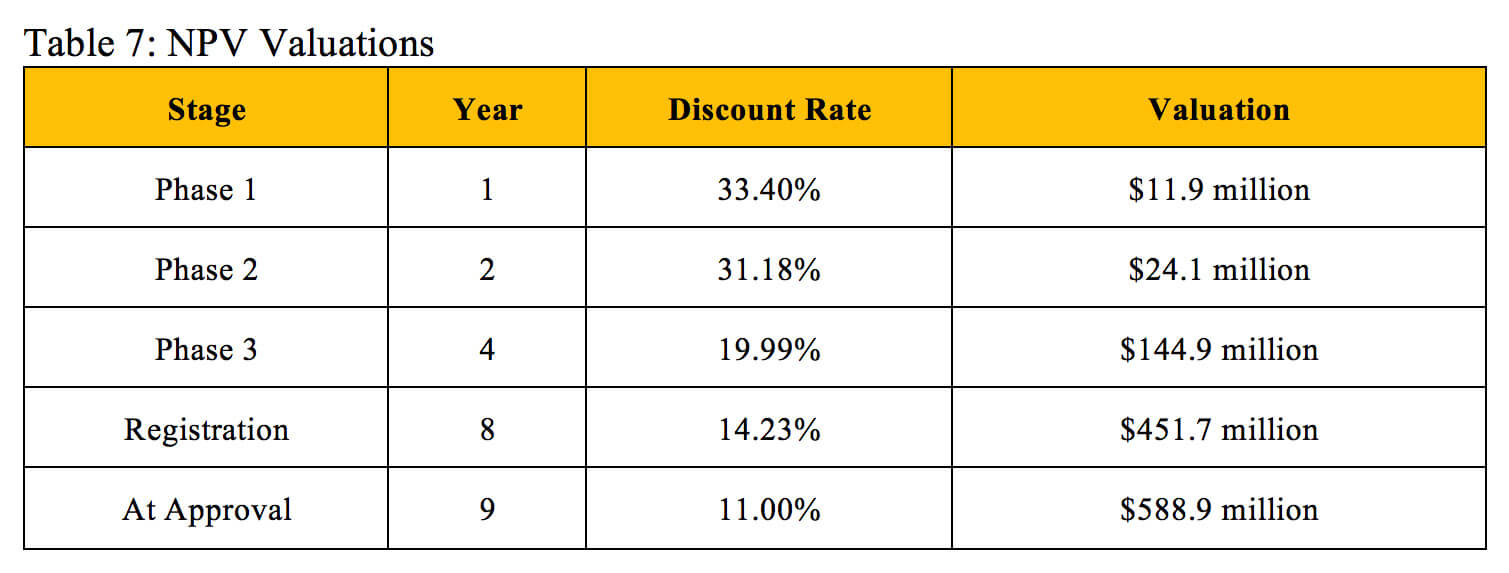

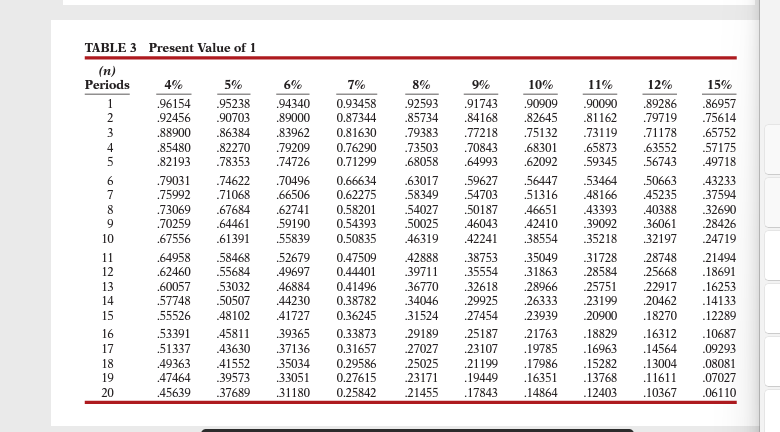

Table 1 from Road Project Investment Evaluation Using Net Present Value (NPV) at Risk Method | Semantic Scholar

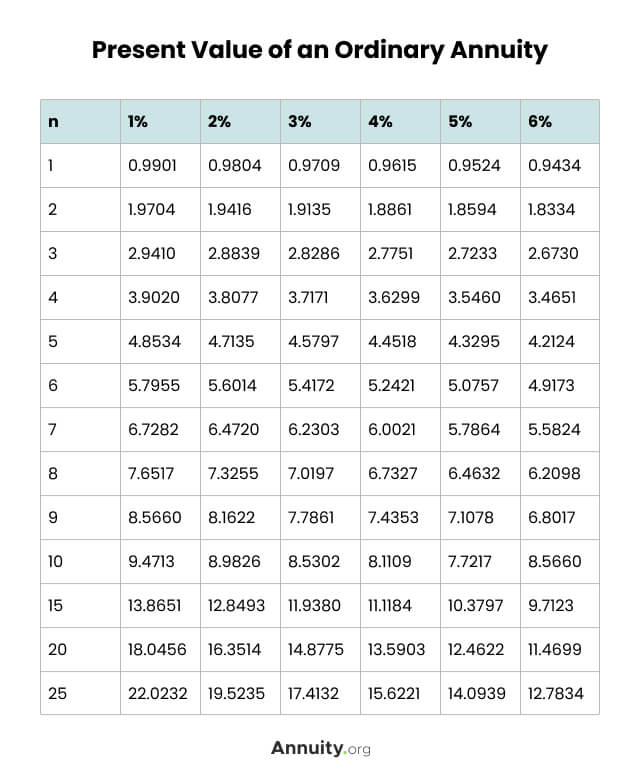

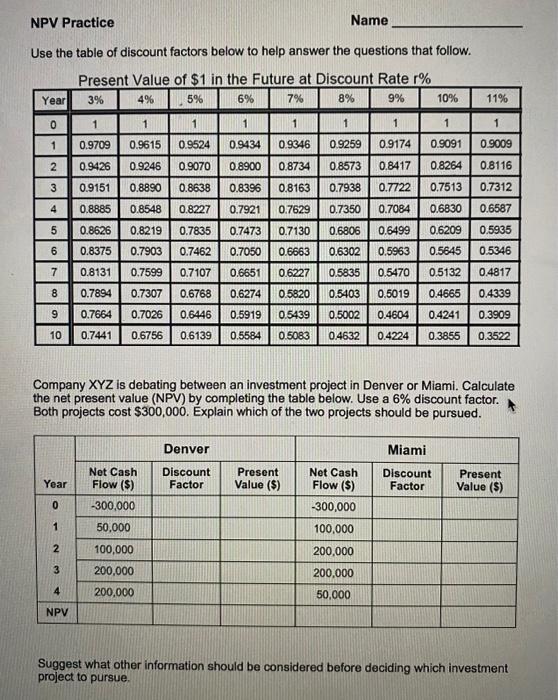

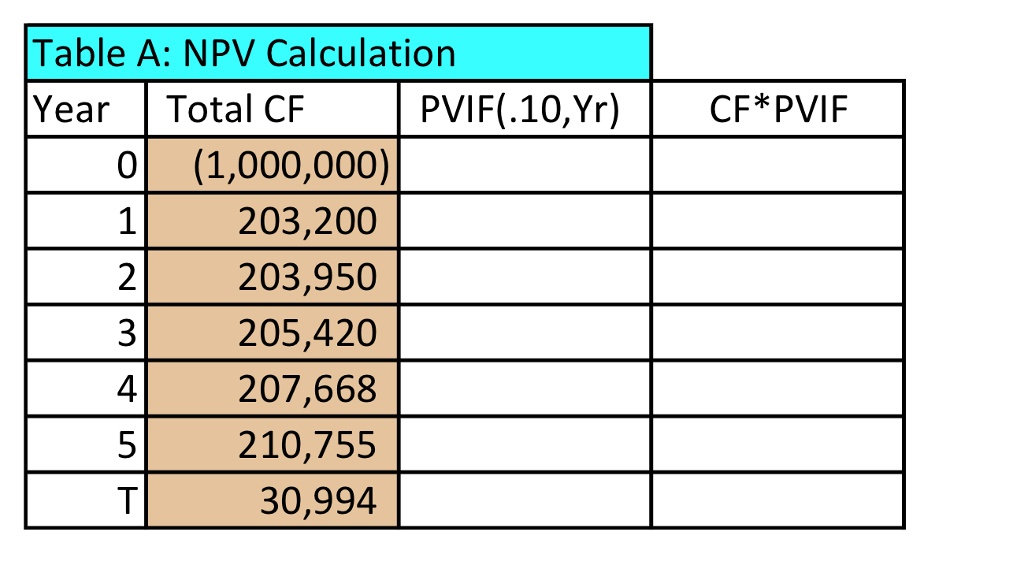

SOLVED: Table A: NPV Calculation Year Total CF PVIF(.10,Yr) 0 (1,000,000) 1 203,200 2 203,950 3 205,420 CF*PVIF 4 5 T 207,668 210,755 30,994