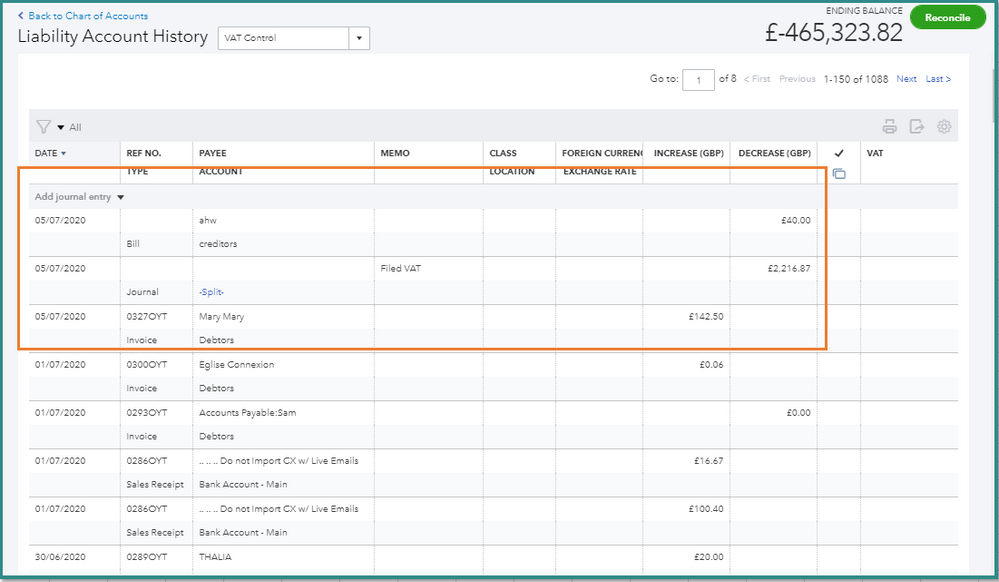

I need to reconcile the VAT control account on QBO as at 31Dec19 to the Q4 2019 UAE VAT payable as per the filing.

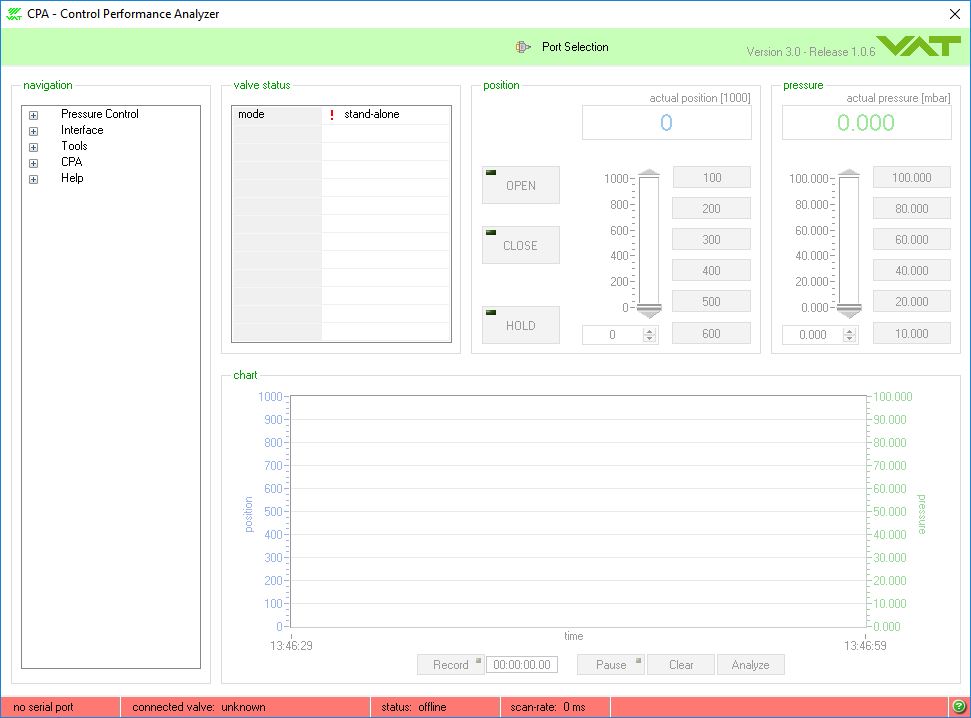

VAT - Control Performance Analyzer Download - Controls valve status and shows the performance and pressure

SOLVED: A debit balance in the VAT control account at the end of a financial period, will be disclosed as a current liability on the statement of financial position of an entity